25-year-old SC Rep. Boyd Brown (D), who is going to law school instead of seeking a third term, bids his colleagues farewell.

Category Archives: Network News/Events

Piñata Politics Just Tempest in a Tea Party Pot

By Becci Robbins

Talk about falling down the rabbit hole. At this time last week I was making a gift for my friend Donna Dewitt to celebrate her retirement from the SC AFL-CIO. And what says party like a piñata?

Yes, the piñata was my idea. I made it. I filled it with candy and Bobby Bucks. I videotaped its predictable demise. I sent the clip to friends to amuse them in these most un-amusing times. Who knew it would go viral?

The breathless response has been over the top, a sad commentary on the echo chamber that is the Internet.

Was the piñata in poor taste? Yes. Was it malicious? No. Am I sorry it caused some people to lose their minds? That’s their problem.

My only regret is having put a dear friend in the position of having to defend a piñata she did not know about or ask for. Donna works harder at a thankless job than anyone I know. She doesn’t deserve the heat she’s taken, including death threats and a promise from Gov. Nikki Haley on national TV to “continue beating up on unions.”

To fixate on unions instead of dealing with the critical problems we’re facing is to use the tired politics of distraction. I should have expected it from the governor, whose favorite posture is that of victim – first of racism, then sexism, now union thugs.

While Haley has made an odd habit of union-bashing, for me she crossed the line when she used her last State of the State address to proclaim: “Unions are not needed, wanted or welcome in South Carolina.” Instead of a message to unite all of us who call the Palmetto State home, she served up a campaign speech of red meat. It was inappropriate. And insulting.

When the governor bashes unions, she’s bashing my colleagues. She’s bashing my friends. She’s bashing my family. She’s bashing me. So forgive me for taking it personally, but I’ve had enough.

The piñata was intended as comic relief among friends after a long day of talking about the state budget, our election system and workers’ rights at the SC Progressive Network‘s annual spring conference. The party was a chance to unwind and honor Donna, our longtime co-chair. For the governor to use the incident for political gain is predictable but unfair, and more than a little ironic.

After all, Donna didn’t do anything as shameful as cut funding for education and mental health services. She didn’t gut environmental regulations or stack boards with corporate cronies. She didn’t show contempt to the Supreme Court. She didn’t campaign on a promise of transparency and then routinely sanitize her paper trail. She didn’t lobby for a corporation while being on their payroll. She didn’t use her power like a bludgeon.

Donna smacked a piñata. Which is, good people, what happens to piñatas. I made one of a Corporate Fat Cat for John Spratt’s retirement party, and it, too, got smashed. Why didn’t it go viral? Because nobody could make political hay out of it.

And that’s exactly what the governor is doing. Yesterday I got an email solicitation from her office inviting me to watch the video and contribute $250 to fight “Big Labor.” The email mentions President Obama twice. Talk about tasteless.

The governor will get no apology from me. But I offer one to Donna for putting her in an awful position. She could have risked hurting my feelings by refusing to play along at the party. Or she could have thrown me under the bus when she started catching heat. She did neither. As a labor leader, she knows something the governor doesn’t: solidarity matters most when it’s inconvenient.

Sorry if this flap has embarrassed any of our members. Please know that Donna and Network Director Brett Bursey have made the best of the rare media attention. (Watch Brett on Fox and Donna on CNN, for starters.)

It may not be pretty, but at least people are talking about organized labor in South Carolina. It’s a conversation that’s long overdue, and it’s up to us to keep it honest.

Becci Robbins is SC Progressive Network Communications Director. Reach her at becci@scpronet.com.

Calling all SC political junkies and social activists

SC Progressive Network Spring Gathering

May 19, 10:30am – 5:30pm

CWA Hall, 566 Chris Dr., West Columbia

Network Co-chair Rep. Joe Neal answers questions at the 2011 Spring Gathering.

PROGRAM

10am: Registration, coffee and doughnuts

10:30 – Welcome and introductions

11 – Missing Voter Project Workshop: Finding, registering and engaging the 50 percent of South Carolinians who don’t vote

11:30 – Racial Profiling Workshop: Are your local cops following the law the Network helped pass? What you can do about it.

Noon – lunch and Social Media Workshop (optional): Everything you wanted to know about social networking but were afraid to ask

1pm – Sorry State of the State: A reality check and a call to organize!

- Update on Network’s recent and future fight for a moral budget, and planning next steps

- Protecting voting rights in South Carolina – what we did last year, and a look at what’s ahead

- Defending the working class and collective bargaining in a fiercely right-to-work state

4 – Network business and political endorsement process

5 – Reception to honor the retiring Donna Dewitt for her years of service to SC’s labor community. She will be the first to take a whack at a Haley pinata.

$10 registration includes conference materials and lunch by Tio’s

RSVP at 803-808-3384 or network@scpronet.com

More about the Network at scpronet.com

We’re all better off when we’re all better off

Sen. Phil Leventis has introduced the “TRAC Recommendation Act” (S 1454) that eliminates or reduces many sales tax exemptions, a move supported by the SC Progressive Network, which has been working to promote fair taxation and sustainable budgets. “Our state’s not broke,” Leventis said at a May 1 press conference, “but we are teetering on the verge of moral bankruptcy in our failure to meet the needs of our citizens.”

Unlike the recommendation by the Republican-sponsored Tax Realignment Commission (TRAC) that called for using new revenue to further lower taxes, Leventis’ bill requires new revenue to be used to fund statutory obligations for education and local governments. The legislation would increase the state’s budget by nearly $1 billion next year.

Leventis noted that during his 32 years as a state senator, “I have been guided by the principle that government should invest in meeting the needs and aspirations of its citizens. This principle has been undermined by an ideology claiming that government is the cause of our problems, and accordingly, must be starved. A government unwilling to invest tax dollars in itself and its citizens is the real source of our problems. When businesses strive to be competitive, they do so by investing in their future. That is what we have to do today in South Carolina to insure a more prosperous future.”

We’re not broke; narrow political ideology has trumped statesmanship. The lack of political will to fairly reform our tax codes to meet our basic civic contracts for education and infrastructure leads our citizens to believe that “minimally adequate” is the best we can hope for.

Leventis was joined by representatives from the SC Progressive Network, a coalition of organizations that represents the interests of a majority of the state’s families who make less than $42,000 a year.

“We don’t expect the legislature to pass the bill this year, but it’s critical for the public to understand that a lot of money is being left on the table,” said Network director Brett Bursey. “It should be up to the taxpayers to decide if their money is best spent on education or on further reducing taxes to compete with Mexico.“

Of all the industrialized nations, only Chile and Mexico have a lower individual tax burden than the United States, according to the Organization for Economic Cooperation and Development. Among the 50 states, South Carolina is ranked 43rd in the nation in taxes as a percentage of income, and dead last in per-capita state taxes (National Tax Foundation).

“We’re all better off, when we’re all better off,” said Network Co-chair Virginia Sanders, citing a recent International Monetary Fund report on the correlation between income inequality and general prosperity.

Our state’s business-friendly climate is reflected in the Forbes ranking that puts South Carolina 5th in its “business friendly regulatory environment” but 44th in quality of life. Forbes ranks the quality of our labor supply at 22nd, far behind North Carolina (third) and Georgia (fourth). “The message this sends is that South Carolina, with its lax regulations and unskilled labor force, is a cheap place to do business — but you might not want to live here,” Bursey said.

The House budget cuts mandatory funding for education by $665 million and local government funds by $71 million. These spending levels are set by law, but EFA and local government funding obligations are ignored by budget provisos due to a presumed lack of revenue and lack of political will. These cuts means larger classes, fewer teachers, police and fire fighters, as well as deteriorating infrastructure, all of which combine to make our state less competitive.

SC Education Association Jackie Hicks addresses the shortfall in education funds that could be helped by Leventis’ bill. See more photos from the press conference here.

The TRAC recommendations on sales taxes would raise nearly $1 billion next year and more in coming years. This is close to what we need to meet these mandatory spending levels, and more comprehensive tax reforms would meet and exceed them for years to come.

“The critical debate I hope to spark,” Leventis said, “is whether the role of our government is shaped by the special-interest groups who make the majority of campaign contributions, or by the citizens who pay the taxes. I believe that citizens are willing to pay fair and equitable taxes when they get their money’s worth. It’s called democracy.”

In this year’s House budget:

• The statutory funding level for the Education Finance Act was cut by $665 million, keeping our per-pupil funding at 1998 levels.

• The statutory funding for local governments’ support of police, fire and public services was cut $71 million.

• The revenue from the extra penny of sales tax for Act 388 was $129.5 million short of what was needed for education funding through sales tax, rather than property tax, requiring another raid on the General Fund.

The House budget shorted mandatory funding of these core public services by nearly $736 million. If you add the $129.5 million shifted from the General Fund, you come up with just about what the TRAC recommendations could recover through broad and fair sales tax reforms.

The TRAC Recommendations Act (S 1454) would:

• Raise the $300 “max tax” on cars, boats and planes and raise $61-$143 million annually as increased caps kick in.

• Tax food (not purchased with food stamps) at an effective rate of 2.41%, raising $251 million next year. 18.2% of the state’s population is receiving SNAP benefits and will pay no tax on food.

• Tax non Medicaid/Medicare medicine (with a $100 cap) and home utilities at an effective rate of 1.25%, raising $124 million next year. Those on Medicare or Medicaid (44% of the state’s children) will pay no tax on medicine.

Is South Carolina broke or morally bankrupt?

By Sen. Phil Leventis

Sumter, SC

With my legislative tenure coming to an end, I want to share something with my fellow South Carolinians. Our state is not broke, but we are teetering on the verge of moral bankruptcy in our failure to meet the needs of our citizens. That’s why I have introduced the TRAC Recommendation Act (S.1454) that eliminates or reduces many sales-tax exemptions. The nearly $1 billion this act will raise annually would be used to pay for education and local governments, which continue to be shorted due to lack of revenue.

During my 32 years as a legislator, I have been guided by the principle that government should invest in meeting the needs and aspirations of its citizens. This principle has been undermined by an ideology claiming that government is the cause of our problems and, accordingly, must be starved.

The real source of our problems is a government unwilling to invest tax dollars in itself and its citizens. When businesses strive to be competitive, they invest in their future. That is what we have to do today in South Carolina to ensure a more prosperous future.

We’re not broke. The problem is that narrow political ideology has trumped statesmanship. The lack of political will to fairly reform our tax code to meet our basic civic contracts for education and infrastructure leads our citizens to believe that “minimally adequate” is the best we can hope for.

In 2010, the Tax Realignment Commission (TRAC) was created to review the state’s tax code and recommend changes “designed to ensure that the state’s tax structure is balanced so that the system is adequate, equitable, and efficient.” The TRAC commissioners and staff did a thorough job of reviewing tax loopholes and inequities, and recommended reforms of sales-tax exemptions that could raise close to $1 billion the first year.

Sadly, ideology trumped common sense, and the Republican-created and -appointed commission’s goal was to use any new revenue to further reduce taxes and increase corporate subsidies, not pay our bills.

Our state’s fixation on being business-friendly is reflected in the Forbes ranking that puts South Carolina fifth in its “business friendly regulatory environment” but 44th in quality of life. Forbes ranks the quality of our labor supply at 22nd, far behind North Carolina (third) and Georgia (fourth). The message this sends is that South Carolina, with its lax regulations and unskilled labor force, is a cheap place to do business — but you might not want to live here.

To put the anti-tax ideology in perspective, consider that of all the industrialized nations, only Turkey and Mexico have a lower individual tax burden than the United States, according to the Organization for Economic Cooperation and Development. The anti-tax National Tax Foundation ranks South Carolina 43rd among the 50 states in taxes as a percentage of income, and dead last in per capita state and local taxes. You begin to wonder why we need to further reduce taxes when we can’t pay our bills.

The House’s budget cuts mandatory funding for education by $665 million and local government funds by $71 million and robs $118 million from the general fund to cover the sales-tax shortfall of Act 388’s property-tax swap. These spending levels are set by law, but education and local government funding obligations are ignored annually by budget provisos because of a presumed lack of revenue and a clear shortage of political courage. These cuts mean larger classes, fewer teachers, police and firefighters and deteriorating infrastructure, all of which combine to make our state less competitive.

The TRAC recommendations on sales taxes would raise nearly $1 billion next year and more in coming years. This is what we need to meet these mandatory spending requirements, and more comprehensive tax reforms would meet and exceed them for years to come.

I’m sponsoring this bill because there is no real legislative debate — and little public understanding — about how we could raise the revenue to pay our bills with fair and broad tax reforms while also improving our quality of life and strengthening our economy.

The critical debate I hope to spark is whether the role of our government is shaped by the special-interest groups who make the majority of campaign contributions, or by the citizens who pay the taxes. I believe that citizens are willing to pay fair and equitable taxes when they get their money’s worth. It’s called democracy, and it’s past time for South Carolinians to reclaim it.

Sen. Leventis is a Sumter businessman; contact him at philleventis@scsenate.gov.

Close campaign finance loopholes; end leadership PACs in SC House

In their ongoing efforts to reduce the corrupting influence of money in state politics, the SC Progressive Network and Common Cause SC, will hold a press conference April 18 at 5:30pm at the courtyard entrance to the Wilbur Smith Building at Gervais and Sumter to bring attention to the high-stakes game of pay-to-play politics.

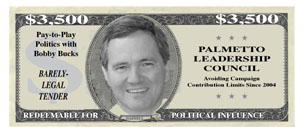

House Speaker Bobby Harrell is hosting a fundraiser at 6pm for his political action committee, the Palmetto Leadership Council, on the building’s 20th floor. Membership in his PAC is $3,500.

“The Speaker’s leadership PAC allows wealthy donors to get around campaign contribution limits,” said John Crangle, Director of Common Cause SC. “It’s the most egregious example of pay-to play politics.”

Crangle’s group was instrumental in getting the state Senate to pass a rule last session banning leadership PACs. “We want to raise public awareness about how Speaker Harrell’s leadership PAC not only enhances corporate influence, but greatly leverages the Speaker’s power over the House,” Crangle said.

“Bobby Bucks” valued at the $3,500 cost of membership in Rep. Harrel’s PAC will be doled out to the public and those attending his fundraiser.

Text on the back of Bobby Buck: Money — rather than good ideas — fuels South Carolina’s politics. Ninety percent of the candidates who spend the most money win. An incumbent who spends the most money, has a 98 percent chance of being elected.

While state ethics laws limit campaign contributions to House races at $1000, a proliferation of political action committees (PACs) allow deep-pocket donors to get around the limit.

For example, the Palmetto Leadership Council is a PAC headed by the SC House Speaker Bobby Harrell. Membership in his Leadership PAC cost $3,500. Harrell says on his PAC’s web site, “We are building a unique coalition between leaders in the private sector and those of us engaged in public service.”

While Harrell, or a corporation like AT&T, can only make a $1000 donation to a House candidate, AT&T can make a $3,500 donation to Harrell’s Leadership PAC, which can then make another $1,000 donation to the same candidate.

Harrell’s PAC has raised nearly $1 million since its founding in 2004, with 98.7 percent going to Republican candidates (79 percent incumbents). More than 89 percent of the candidates backed by Harrell’s PAC won election.

Harrell’s largest donations were $100,000 checks written to the state Republican Party. The party can then make a $5,000 contribution to the same candidate that received the $1,000 maximum from Harrell’s PAC. It’s a way around campaign finance laws, and it’s legal.

Join the SC Progressive Network and Common Cause’s efforts to reduce the influence of money in politics. Tell Rep. Harrell and other House members to follow the state Senate’s lead and end House leadership PACs.

Information gathered from:

The National Institute on Money in State Politics

(enter Palmetto Leadership Council in the search block)

All we are saying is end corporate crime!

Our friend Dave Lippman singing truth to power.

Report: $70 million in SC workers’ taxes diverted yearly to pay corporate subsidies

Nearly $700 million a year in state income taxes withheld from worker paychecks in 16 states is being used to provide lavish subsidies to corporations rather than paying for vital public services. These diversions have gone to more than 2,700 companies, including major firms such as Sears, Goldman Sachs and General Electric. Few, if any, of the affected workers are aware, because no state requires they be informed on their pay stubs.

South Carolina’s Job Development Credits cost $70.3 million per year, the fourth-costliest diversion among the states. “Putting aside the question of this being a good investment of tax dollars, the immediate problem is a lack of transparency,” said Dr. Hoyt Wheeler, Co-chair of the SC Progressive Network.” Wheeler, a retired business professor, noted that the SC Department of Revenue does not reveal the credit amounts the 221 companies receive, or require the workers to be notified that their employer is pocketing their state income tax. “Individual workers at some of these companies can be donating as much as $1.25 an hour for years to the corporate bottom line, while thinking they are helping pay for schools and infrastructure,” Wheeler said.

These are the key findings of Paying Taxes to the Boss: How a Growing Number of States Subsidize Companies with the Withholding Taxes of Workers, a study published today by Good Jobs First, a non-profit, non-partisan research center based in Washington, DC. It is available here.

“Diversion of personal income tax revenues into subsidies violates how economic development has been defined,” said Good Jobs First Executive Director Greg LeRoy. “States are draining a revenue source that helps many of them address structural deficits.”

Paying Taxes to the Boss traces the rise of 22 subsidy programs derived from personal income taxes (PIT) that together cost about $684 million a year. “These programs are justified in the name of job creation, but they often end up subsidizing companies to move existing jobs from one state to another. In other cases, they go to employers that threaten to move unless they get paid to stay put,” said Philip Mattera, research director of Good Jobs First and principal author of the report.

“We recommend that states seriously consider abolishing PIT-based subsidies. Short of that, we urge Truth in Taxation: that companies be required to disclose the details of how much money is going where on every pay stub of affected workers,” LeRoy added.

The report examines South Carolina’s PIT-based subsidy program, known as Job Development Credits, or “JDC”. The JDCs are considered by the state Department of Commerce to be the “most significant incentive created by the 1995 Enterprise Zone legislation. The programs work in various ways in different states. Some allow employers to immediately retain (and never remit to the state) a large portion of the withholding taxes generated by designated new or retained workers. Some provide cash rebates or grants calculated the same way. Others provide credits against corporate income taxes or other business levies, with the value of those credits based on the withholding taxes of new or retained workers. (Some of these credits are cash-refundable if the credit exceeds the company’s tax liability.)

The share of withholding taxes diverted into subsidies can be as high as 100 percent (such as EDGE tax credits in Illinois and Indiana) and the duration can be as long as 25 years (such as Mississippi’s Withholding Rebates). Twelve programs divert 75 percent or more of withholding, and 18 do so for 10 years or longer.

The most expensive program is New Jersey’s BEIP, which in FY2011 approved new grants worth up to $73.2 million over their multi-year terms and disbursed $178 million during the year for previously approved contracts. Among states with subsidy recipient disclosure, those with the largest number of participants in PIT-based programs are: Ohio (567), Kentucky (509), Illinois (315), New Jersey (306) and Indiana (283).

Network joins SC Small Business Chamber in screening new documentary “We’re Not Broke”

The SC Progressive Network‘s monthly movie night is changing time and location to co-sponsor the newly released 80-minute documentary We’re Not Broke. The public is invited to a free screening on Wednesday, April 25, 6:3-8:30pm at the USC Law School Auditorium, 701 S. Main.

After the screening, the film’s director, producer and writer—Karin Hayes—will be with us to answer questions. The evening will conclude with a discussion of the next steps to advocate for Congress to close corporate tax loopholes, end offshore tax havens and resist another repatriation tax holiday. This free event sponsored by the SC Small Business Chamber of Commerce.

With the United States in the grip of the worst economic recession since the Great Depression and an unprecedented budget deficit, the conclusion that our country is broke seems unquestionable. At least that’s what politicians and pundits want ordinary citizens to believe as they call for massive spending cuts.

Karin Hayes and Victoria Bruce’s searing exposé reveals that, strangely absent from this rhetoric, is the infuriating fact that multibillion-dollar corporations are based in the U.S., make money from American consumers, and often even receive lucrative contracts from the government, yet pay nothing in U.S. income taxes. By exploiting tax-law loopholes and spending millions on lobbyists to pressure politicians to protect their interests, corporations pocket billions while the less-connected middle class disappears, and the poor get poorer.

We’re Not Broke explores how the government has allowed this inequality to develop and the growing wave of discontent that it has fostered. Presaging the larger wave of protests that have arisen in recent months with the international Occupy movement, the film follows a number of activists who have had enough and are demanding that corporations finally pay their fair share.

2012 Missing Voter Project training available

The Network’s Missing Voter Project has registered nearly 10,000 new SC voters since 2004. We have updated our Organizer’s Tool Kit that guides volunteers through the registration process and provides tools to organize high school and community MVP teams.

To schedule a training, call 803-808-3384 or email network@scpronet.com. For more about the project, click here.