Sen. Phil Leventis has introduced the “TRAC Recommendation Act” (S 1454) that eliminates or reduces many sales tax exemptions, a move supported by the SC Progressive Network, which has been working to promote fair taxation and sustainable budgets. “Our state’s not broke,” Leventis said at a May 1 press conference, “but we are teetering on the verge of moral bankruptcy in our failure to meet the needs of our citizens.”

Unlike the recommendation by the Republican-sponsored Tax Realignment Commission (TRAC) that called for using new revenue to further lower taxes, Leventis’ bill requires new revenue to be used to fund statutory obligations for education and local governments. The legislation would increase the state’s budget by nearly $1 billion next year.

Leventis noted that during his 32 years as a state senator, “I have been guided by the principle that government should invest in meeting the needs and aspirations of its citizens. This principle has been undermined by an ideology claiming that government is the cause of our problems, and accordingly, must be starved. A government unwilling to invest tax dollars in itself and its citizens is the real source of our problems. When businesses strive to be competitive, they do so by investing in their future. That is what we have to do today in South Carolina to insure a more prosperous future.”

We’re not broke; narrow political ideology has trumped statesmanship. The lack of political will to fairly reform our tax codes to meet our basic civic contracts for education and infrastructure leads our citizens to believe that “minimally adequate” is the best we can hope for.

Leventis was joined by representatives from the SC Progressive Network, a coalition of organizations that represents the interests of a majority of the state’s families who make less than $42,000 a year.

“We don’t expect the legislature to pass the bill this year, but it’s critical for the public to understand that a lot of money is being left on the table,” said Network director Brett Bursey. “It should be up to the taxpayers to decide if their money is best spent on education or on further reducing taxes to compete with Mexico.“

Of all the industrialized nations, only Chile and Mexico have a lower individual tax burden than the United States, according to the Organization for Economic Cooperation and Development. Among the 50 states, South Carolina is ranked 43rd in the nation in taxes as a percentage of income, and dead last in per-capita state taxes (National Tax Foundation).

“We’re all better off, when we’re all better off,” said Network Co-chair Virginia Sanders, citing a recent International Monetary Fund report on the correlation between income inequality and general prosperity.

Our state’s business-friendly climate is reflected in the Forbes ranking that puts South Carolina 5th in its “business friendly regulatory environment” but 44th in quality of life. Forbes ranks the quality of our labor supply at 22nd, far behind North Carolina (third) and Georgia (fourth). “The message this sends is that South Carolina, with its lax regulations and unskilled labor force, is a cheap place to do business — but you might not want to live here,” Bursey said.

The House budget cuts mandatory funding for education by $665 million and local government funds by $71 million. These spending levels are set by law, but EFA and local government funding obligations are ignored by budget provisos due to a presumed lack of revenue and lack of political will. These cuts means larger classes, fewer teachers, police and fire fighters, as well as deteriorating infrastructure, all of which combine to make our state less competitive.

SC Education Association Jackie Hicks addresses the shortfall in education funds that could be helped by Leventis’ bill. See more photos from the press conference here.

The TRAC recommendations on sales taxes would raise nearly $1 billion next year and more in coming years. This is close to what we need to meet these mandatory spending levels, and more comprehensive tax reforms would meet and exceed them for years to come.

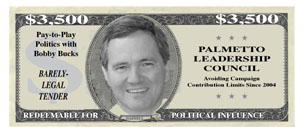

“The critical debate I hope to spark,” Leventis said, “is whether the role of our government is shaped by the special-interest groups who make the majority of campaign contributions, or by the citizens who pay the taxes. I believe that citizens are willing to pay fair and equitable taxes when they get their money’s worth. It’s called democracy.”

In this year’s House budget:

• The statutory funding level for the Education Finance Act was cut by $665 million, keeping our per-pupil funding at 1998 levels.

• The statutory funding for local governments’ support of police, fire and public services was cut $71 million.

• The revenue from the extra penny of sales tax for Act 388 was $129.5 million short of what was needed for education funding through sales tax, rather than property tax, requiring another raid on the General Fund.

The House budget shorted mandatory funding of these core public services by nearly $736 million. If you add the $129.5 million shifted from the General Fund, you come up with just about what the TRAC recommendations could recover through broad and fair sales tax reforms.

The TRAC Recommendations Act (S 1454) would:

• Raise the $300 “max tax” on cars, boats and planes and raise $61-$143 million annually as increased caps kick in.

• Tax food (not purchased with food stamps) at an effective rate of 2.41%, raising $251 million next year. 18.2% of the state’s population is receiving SNAP benefits and will pay no tax on food.

• Tax non Medicaid/Medicare medicine (with a $100 cap) and home utilities at an effective rate of 1.25%, raising $124 million next year. Those on Medicare or Medicaid (44% of the state’s children) will pay no tax on medicine.