Category Archives: SC News/Commentary

New photo ID law poses big obstacles for countless SC voters

Stories like this are coming in from all over South Carolina. Fortunately for Mr. Butler, he has a computer, a car, a son to help him gather documents, and the money to pay for court costs. But what about voters without those resources?

Don’t miss our 15th annual spring gathering!

Join us for a day of fellowship with allies and mapping strategy for the coming months. The event is free and open to anyone interested in promoting a progressive agenda in the Palmetto State.

11:30 – 12:30 – Registration and lunch. Lunch is $10; please RSVP for lunch at network@scpronet.com or 803-808-3384.

12:30 – Introductions and welcome. Overview of the Network’s goals, strategies and tactics. Reports from the field.

1:30pm – Policy work

• Review our moral budget campaign and look ahead to the budget in the coming legislative session

• Understanding SC’s new voter photo ID law and our campaign to stop it in the Justice Department

• “Are your papers in order?” A look at SC’s pending anti-immigrant legislation

• Redistricting. What’s happening and what are the implications

• SC organized labor under assault; what can we do?

• Reproductive rights: victories and challenges in SC

• Hate crimes legislation: an update

2:30 – Policy priorities for the coming year

3:00 – Break

3:15 – Network Education Fund business (501-c-3)

• How can the Network Education Fund better serve your organization?

• Financial report and fundraising.

• Communications report

• By-laws changes

3:45 – Progressive Network individual members business (501-c-4)

• Movement building, political parties and strengthening our base

• ProVote – mapping strategy

• The Network’s relationship with national organizations. How can we work more collaboratively?

• Summer projects

• Fall retreat: making plans for our next statewide gathering

5pm: Meet and mingle

South Carolina is giving away more corporate tax breaks, while cutting aid to the jobless

By Pat Garofalo

“The South Carolina state Senate … is cooking up a budget that includes $100 million in corporate tax breaks … Already, the state has reduced its benefits under the Temporary Assistance for Needy Families (TANF) program by 20 percent to $216 per month, which is just 14 percent of the poverty line.

And as The Huffington Post’s Arthur Delaney reported, South Carolina is also looking at cutting its unemployment insurance system: ‘The South Carolina State Senate gave preliminary approval last week to a bill that would reduce state unemployment benefits from 26 weeks to 20 weeks…'”

More here.

Progressive Network launches campaign to stop photo ID law, calling it a dressed-up poll tax

By Becci Robbins

SC Progressive Network Communications Director

Gov. Nikki Haley today signed into law a bill that will mandate people have a photo ID to vote.

The SC Progressive Network and other voting rights advocates have been fighting this unnecessary law for four years, arguing that it is a solution in search of a problem.

“This law will prevent thousands of South Carolinians from voting,” said Network Director Brett Bursey. “There is no evidence of anyone ever having pretended to be someone else at the polls. The clear intent of this law — passed by a Republican party-line vote — is to suppress the vote of poor people and minorities, who historically vote Democrat.”

“The people here celebrating the signing of this bill – Gov. Haley, Rep. Clemmons, Sen. Peeler – none of them have ever experienced the racial discrimination that kept many people in Orangeburg from voting,” said Rep. Bakari Sellers (D-Orangeburg). “Racial discrimination is not something from the distant past, and this bill insures it will happen in the immediate future.” Sellers’ father was shot during a protest against segregation in Orangeburg in 1968.

Members of the SC Legislative Black Caucus speak against the bill. More photos here.

The SC Election Commission found that 178,175 citizens have voter registration cards that do not have a state- issued photo ID. The top 15 counties, by percentage of voters without photo ID, all have a majority of minority population that historically vote Democrat. In Richland County alone, 18,865 voters do not have state-issued photo ID.

The Progressive Network will be gathering affidavits documenting the difficulties and expenses of those attempting to get photo IDs. These affidavits will be submitted to the US Justice Department as it considers whether the law disenfranchises minority voters. There is a 60-day window to present comments. Due to a history of racial discrimination, South Carolina must have all laws that affect voting rights “pre-cleared” by the US Justice Department.

While three other pre-clearance states (AZ, GA, LA) have gotten Justice Department approval for their photo ID laws, the laws in these states are not as restrictive as South Carolina’s. The other states allow voters to obtain photo IDs with documents ranging from tax forms to payment stubs.

“We are calling on people who don’t have photo IDs to begin the process of getting one now,” said Network Co-chair Virginia Sanders. “We need to document the difficulties and expenses within the next 60 days, so don’t wait until the next election time comes around.”

The Dept of Motor Vehicles requires a birth certificate, or other government-issued ID, in order to obtain a state-issued ID card. DHEC requires a state- or federal-issued photo ID to get a birth certificate.

“We are working with a group in Sumter County that has already found eight registered voters having serious difficulty getting a photo ID,” Sanders said. “Some don’t have a birth certificate and weren’t born in a hospital. Others are being told they will have to go to court to get their names changed if it was misspelled on their birth certificate. The legal hoops they have to jump through are expensive. This is, in effect, a poll tax.”

DHEC advises citizens they can go online to “VitalCheck” to get a copy of their birth certificate. To use this service, one has to have a computer, email address, phone number and one of four major credit cards. The average cost for this service is $30.

Anyone having difficulty in obtaining a photo ID should contact the SC Progressive Network at 803-808-3384 or network@scpronet.com.

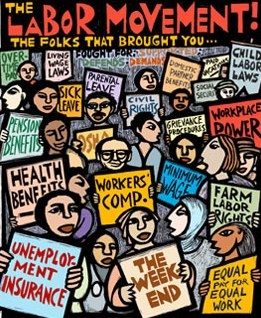

SC workers should remember their labor history

By Hoyt Wheeler, West Columbia

Unions are in the news. Protesters by the thousands contest the repeal of public employee bargaining rights in Wisconsin and Ohio. Legislators in South Carolina continue to propose new ways to prevent the growth of union rights in our state. But is this good public policy?

Since the 1880s, South Carolina has pursued a strategy of industrial development that has emphasized offering cheap, docile labor to employers.

The paternalism of the textile companies was benevolent, but only if the workers avoided acting together in opposition to management. That was met by strenuous and often brutal repression. This is the historic legacy of industrialism in South Carolina.

Today S.C. employers have suppressed the efforts of most employees to gather together to collectively assert their rights and interests through labor unions. Those who dare to express disagreement with anti-union practices and laws are subjected to pressure and, if possible, punishment. Our governor declares herself committed to opposing unions. Yet the right to bargain collectively is internationally recognized as a fundamental human right, giving workers dignity at the workplace and the prospect of a decent income. It is the polar opposite of the old practice of human slavery that has long poisoned South Carolina’s society and culture.

A symptom of the great power of our union-averse corporate community is the spate of anti-union legislation making its way through our Legislature. Last year we had a state constitutional amendment that provided that all matters of employee representation would be decided by secret ballot, despite the fact that the federal authority takes precedence in labor matters. A bill currently making its way through the Legislature would exempt S.C. employers from complying with a proposed federal requirement that they post a notice informing their employees of their legal rights regarding unions. I believe such laws violate the U.S. Constitution.

But what would be the consequence if these attempts to stave off unionization were to fail? Well, to begin with, union workers make more money than non-union workers, and are much more likely to have good health insurance and a solid pension. This would be good for the unionized workers, which in turn would create a demand for more products and services in the state. Instead of benefits trickling down from the wealthy, the prosperity of the many would percolate up to benefit all of us. Perhaps more importantly, collective bargaining agreements guarantee just treatment to employees. Without a union contract, an employee can be fired unless she can prove discrimination on the basis of race, sex or other prohibited grounds. A unionized worker can be terminated only for proven just cause, or laid off if there is no work available.

With the possible exception of an odd case such as Boeing, which may be in violation of federal labor laws, I would argue that stronger unions would not inhibit industrial development, the holy grail of S.C. politics. South Carolina can no longer compete on cheap wages, because even S.C. workers will not work for the wages that are paid in India or China.

My experience in a half-century of working, teaching and researching in this field convinces me that competent managers can work quite effectively with a union. Managers, quite understandably, do not like to share power with their workers’ representative, but no one has a stronger interest in the welfare of a business than the rank-and-file workers who are tied to their community and their job. Union officers hold office by the consent of the workers or their elected officials, and must reflect the views of the members. The bugaboo of dreaded union “work rules” are, in fact, negotiated conditions of work jointly arrived at between employers and unions.

South Carolina is a beautiful state with a wonderful climate and kind, generous and hard-working people. Our economy would profit greatly by the increased pay, benefits and security that unions can offer. Unions have the potential to help transform our state into a leader in the positive aspects of an economy and society instead of being a leader in negative statistics and a laggard in positive ones.

Hoyt Wheeler, a retired attorney and professor living in West Columbia, serves on the executive committee of the SC Progressive Network. Among his writings are The Future of the American Labor Movement and Workplace Justice Without Unions.

As Senate takes up budget, town hall panel to debate role of special-interest tax breaks

Is South Carolina broke? That’s what the governor and a majority of the state legislature are saying. What if the state isn’t broke, but is leaving billions in revenue out of the budget because of special-interest tax breaks?

That’s the question to be debated at a town hall meeting April 27, 7pm, at the SC State Museum, 301 Gervais St. in Columbia. The forum is free and open to the public.

With the Senate set to begin debate on the budget April 26, it’s important that the public have a say in our funding priorities. The town hall was organized because the Senate is not allowing any opportunity for public comment during its deliberations.

The town hall will debate the argument that the state is broke, and will provide striking details about the $4 billion left out of the budget through special tax breaks.

Dr. Holley Ulbrich, Professor Emerita of Economics at Clemson University, will present the case that there is sufficient revenue to fund a moral budget that reflects our values as a society. “By any measure, our state and local tax system has failed to reflect our shared values of justice, of freedom, of compassion, and of opportunity,” Ulbrich said. “Instead, we have focused on tax cuts and failed to update our antiquated revenue system, standing idly by while our tax base continues to erode.”

Dr. Mike Fanning, who has been working with Chambers of Commerce across the state to promote comprehensive tax reform, will lay out the case to lower taxes and balance the budget. “How can a state claim to be broke?” Fanning asked. “Our legislators choose to collect taxes at twice the rate needed to run government while giving away billions in special interest exemptions.”

Network Director Brett Bursey said, “The Chambers of Commerce and the Progressive Network agree that tax breaks are leaving too much money on the table and that our political leadership refuses to acknowledge that the money exists. When the public understands we’re not broke and forces the politicians to reform the tax code, then we can have a productive fight over how to spend the money.”

The Chambers would use the revenue to reduce state taxes and balance the budget. The Network wants the money to enhance the budget and fund crumbling public services. The legislature and the governor are opposed to raising revenue, and see no alternative to cutting government programs.

After a panel discussion, the public will be invited to ask questions and make comments. This is a 90-minute opportunity for the public to understand that South Carolina is not broke, and that the real debate should be over what to do with the additional revenue.

A 2011 study by the Tax Foundation found that South Carolinians have the lowest state income tax burden in the nation and rank 43rd in combined state and local taxes.

The Organization of Economic Cooperation and Development, with 34 “first world” member nations, ranks the United States 33rd in collection of taxes, compared to the country’s wealth. Only Mexico ranked lower.

SC businesses slam Senate Finance Committee’s lack of transparency on Amazon deal

The South Carolina Alliance for Main Street Fairness today responded to a last-minute hearing scheduled by the full Senate Finance Committee on Amazon’s special deal, which exempts them from collecting the sales tax. By bypassing subcommittee hearings, senators have cut off a public debate and prohibited South Carolina businesses owners who would be negatively impacted by this special deal from testifying publicly.

“Lawmakers attempting to ram through legislation for Amazon without a public debate sends a message that rewarding an out-of-state company with a special deal is more important than the thousands of other South Carolina employers who play by the rules and are just asking for a level playing field. By bypassing subcommittee hearings, senators are cutting off those who would be most affected by Amazon’s special deal: existing South Carolina employers,” said Brian Flynn, spokesperson for the South Carolina Alliance for Main Street Fairness.

“It certainly appears the Senate Finance Committee is not interested in seeing or hearing from employers who could lose their livelihoods if the state makes a special deal for one company. Passing a special deal that gives an out-of-state company a special advantage over existing South Carolina businesses would be bad enough, but ramming it through and silencing the very businesses owners who would be affected is an insult to every job provider throughout the state.”

BACKGROUND:

“A proposal to give online retail giant Amazon.com a break from collecting South Carolina sales taxes has been put on a fast track for debate. The full Senate Finance Committee is scheduled to debate the measure Tuesday and bypass subcommittee hearings that would let the public tell senators what they think about the measure.” (“SC Senate Panel To Take Up Amazon Sales Tax Break,” The Associated Press, 4/19/11)

Network to host roundtable on SC budget crisis

TOWN HALL

Is South Carolina broke? Or is our tax system broken?

April 27, 7 – 8:30 pm

SC State Museum, 301 Gervais Street, Columbia

FREE and open to the public!

PANEL

Moderator: Brett Bursey, Director, SC Progressive Network

Dr. Mike Fanning, Reduce Our Awful Tax Rates

Dr. Holley Ulbrich, Professor Emerita of Economics, Clemson University

TALK BACK

After a panel discussion about the state budget crisis and possible alternatives to cuts in critical services, the public will be invited to ask questions and make comments. We need YOU at the table for this important conversation. Come out and speak up!

You are invited to join us for a reception afterward.

For details, call 803-808-3384 or email network@scpronet.com.

State trends: hostility to abortion rights increases

Through March 31, legislators introduced 916 measures related to reproductive health and rights in the 49 state legislatures that had convened their regular session. (Louisiana’s legislature will not convene until late April.)

By the end of March, seven states had enacted 15 new laws on these issues, including provisions that:

- expand the pre-abortion waiting period requirement in South Dakota to make it the most onerous in the country, by extending the time from 24 hours to 72 hours and requiring women to visit a crisis pregnancy center in the interim;

- expand the abortion counseling requirement in South Dakota to mandate that counseling be provided in-person by the physician who will perform the abortion and that counseling include information published after 1972 on all the risk factors related to abortion complications, even if the data are scientifically flawed;

- require the health departments in Utah and Virginia to develop new regulations governing abortion clinics;

- revise the Utah abortion refusal clause to allow any hospital employee to refuse to participate in any way” in an abortion;

- limit abortion coverage in all private health plans in Utah, including plans that will be offered in the state’s health exchange; and

- revise the Mississippi sex education law to require all school districts to provide abstinence-only sex education, while permitting discussion of contraception only with prior approval from the state.

In addition to these laws, more than 120 other bills have been approved by at least one chamber of the legislature, and some interesting trends are emerging.

As a whole, the proposals introduced this year are more hostile to abortion rights than in the past: Fifty-six percent of the bills introduced so far this year seek to restrict abortion access, compared with 38% in 2010. Three topics—insurance coverage of abortion, restriction of abortion after a specific point in gestation and ultrasound requirements—are topping the agenda in several states.

At the same time, legislators are proposing little in the way of proactive initiatives aimed at expanding access to reproductive health-related services. This stands in sharp contrast to recent years, when a range of initiatives to promote comprehensive sex education, permit expedited STI treatment for patients’ partners and ensure insurance coverage of contraception were adopted. For the moment, at least, supporters of reproductive health and rights are almost uniformly playing defense at the state level.

The Guttmacher Institute works to advance sexual and reproductive health in the United States and worldwide through an interrelated program of social science research, policy analysis and public education designed to generate new ideas, encourage enlightened public debate and promote sound policy and program development. Learn more at Guttmacher.org.