Category Archives: SC News/Commentary

Tell Them

Activists pack State House to say: Stop the cuts!

See photos here.

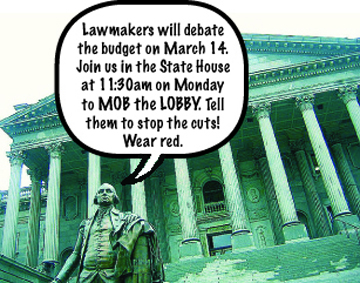

Mob the Lobby Monday, March 14

Activists to “Mob the Lobby” Monday, March 14

South Carolinians preparing to rally at the State House to demand a moral budget on Saturday plan to return Monday, when the House starts debate in a special session. Supporters of a moral budget will be asking legislators to cut special-interest tax breaks before cutting critical public services.

“I’m afraid they plan to ram through an immoral budget,” said Rep. Joe Neal, a member of the House Budget Committee. “They have the votes to do it.”

Rally sponsors are urging their supporters to return to the State House on Monday to “Mob the Lobby” to tell lawmakers: Stop the cuts. The money’s here. Fund a moral budget.

“We didn’t get into this mess overnight,” said SC Employees Association Interim Director Joe Benton. “We won’t solve it with a single rally. We need to come back on Monday. This is a longer commitment to doing what’s right for all South Carolinians.”

To help Mob the Lobby, the public is invited to wear red and gather in the State House lobby 11:30 a.m. Monday, March 14. See scpronet.com for details.

SC groups join forces to rally for a moral budget

By Becci Robbins

SC Progressive Network

A growing number of churches, educators, health care providers, grassroots groups and professional organizations will rally in Columbia on Saturday, March 12, at 1pm at the State House to demand that lawmakers “Stop the cuts! Fund a moral budget.” The House begins debate on the budget March 15.

“Budgets are moral documents” said Rev. Brenda Kneece, Executive Minister of the SC Christian Action Council. “A civilized society chooses to do together what individuals or organizations cannot do alone: protect all and provide for the vulnerable.”

According to the recent report by the Tax Realignment Commission (TRAC), created by the legislature to reform SC tax codes — a report that was quickly shelved — South Carolina imposes one of the country’s lowest individual income tax burdens. An estimated $3.7 billion was left out of the current budget due to sales and service tax exemptions alone.

“The problem isn’t money,” said Brett Bursey, Director of the SC Progressive Network. “The problem is a political ideology that’s both anti-government and anti-taxes. Exemptions, deductions and tax credits leave enough money out of the state budget to meet our needs, with some left over for improvements. We have to send a clear message to the legislature that the race to the bottom must end, and revenue must be raised to fund critical services.

“The money is there,” Bursey said. “The political will is not.”

“We are 1,000 percent behind this rally and are urging all state employees to be there,” said SC State Employee’s Association Interim Director Joe Benton. “Further budget cuts will result in more layoffs and furloughs that hurt not only state employees and their families, but the citizens they serve.”

Jackie Hicks, President of the South Carolina Education Association, South Carolina’s oldest and largest professional association of educators, is encouraging her members to rally to protect and defend public education. “For too long, we’ve allowed legislators to shirk their duty to provide adequate, equitable and stable funding for South Carolina’s public schools and the students they serve. Our current funding is totally inadequate for the educational services our students need.”

Rev. Kneece said, “As faithful citizens we are called to come together through budgets and the taxes that fund them to “Speak up for those who cannot speak for themselves, for the rights of all who are destitute. Speak up and judge fairly; defend the rights of the poor and needy (Proverbs 31:8-9, New International Version).”

Over the past two years, the state budget has been cut from $7.9 to $5 billion, making severe cuts to state services. Further cuts, being debated in the legislature, propose more reductions in health care services to nearly 900,000 Medicaid recipients, ending preventative care, AIDs drug programs, aid for needy children; more teacher’s jobs lost, larger classes, higher tuition; the end of SCETV and the Arts Commission – just to name a few of the casualties.

Life will be harder, with fewer opportunities, especially for the 25 percent of our children living in poverty.

Initial Sponsors: SC AFL-CIO • SC Christian Action Council • SC Education Association • S.C. HIV/AIDS Care Crisis Task Force • SC NAACP • SC Progressive Network • SC State Employees Association • Ties That Bind

For more information, see scpronet.com, email network@scpronet.com or call 803-808-3384.

The budget is a moral document

Dr. Holley Ulbrich

Senior Scholar, Strom Thurmond Institute

A budget is a moral document. It expresses our values and our priorities as South Carolinians. It reminds us that each of us, four million plus South Carolinians, has needs to be met and gifts to offer the world.

One of our most deeply held American values is justice. We try to do that work of justice and compassion as individuals and through congregations and other private organizations. But the task is enormous. These scattered and individual efforts are not enough. Fifteen percent of South Carolinians lives in poverty—the 9th highest rate in the country.

Our underfunded schools are failing to develop our children’s talents and prepare them to become self-supporting, contributing members of society. We are not taking on those reciprocal responsibilities to one another as fellow citizens of South Carolina. The budget is an expression of our obligations to one another, and at present our budget demonstrates a lack of commitment, a failure to pay more than lip service to our shared values.

To treat everyone justly and fairly, we need to provide them with both freedom and opportunity. Freedom is not just freedom to, it is also freedom from. The four freedoms—freedom of speech and religion, freedom from want and fear—are all essential to human flourishing. Our children will not have that freedom and opportunity without providing them an adequate education for a demanding 21st century economy.

Those who cannot earn enough on their own—the disabled, the sick, the elderly, the children in single-parent homes where working mothers can’t earn enough to meet their needs—do not have freedom from want and fear, or opportunity to escape from poverty. Prisoners who are overcrowded and lack access to exercise and education have little or no opportunity to re-enter society as productive human beings leading meaningful lives.

The failure to maintain the state’s infrastructure, especially transportation infrastructure, will make it increasingly difficult to attract and retain business firms to provide employment opportunities for our workers, who still suffer from one of the highest unemployment rates in the nation.

Yet our state General Fund spending per person, adjusted for inflation, is lower than it was 10 years ago-$1,156,compared to $1,229 in the 1999-2000 budget. The 2010 budget per person was at the 1984 level in constant dollars. We are asking our teachers, our prisons, our colleges and universities, our health services and public safety officers to do more with less, and do it with 21st century technology.

Is there another way? Yes.

The budget is a moral document not only on the spending side, which displays our priorities for all to see, but also on the revenue side. How much are we able and willing to contribute to meeting the needs of our fellow citizens? By any measure, our state and local tax system has failed to reflect our shared values of justice, of freedom, of compassion, and of opportunity. Instead, we have focused on tax cuts and failed to update our antiquated revenue system, standing idly by while our tax base continues to erode.

Taxes are low in South Carolina, and getting lower. South Carolina ranks 47th out of 51 states (including the District of Columbia) in taxes as a percent of income and 51st in taxes per capita. Yet low taxes have not succeeded in the supposed goal of attracting and retaining industry, because business firms care about more than taxes. Business location studies show that firms care about an educated work force, an adequate transportation system, a consumer market that can afford to buy their products and services, and quality of life for the firm’s employees.

South Carolina’s sales tax system is eroding rapidly. One factor in that erosion is tax cuts over the last 10 years. Changes in the income tax that allow unincorporated business to file at the same 5% rate as corporations and eliminate the bottom bracket (which affects all taxpayers) on the individual income tax have cost the state more than $200 million a year. State-funded property tax relief has been a major drain on the state’s revenue.

The homestead exemption for the elderly and the original relief on the first $100,000 of owner-occupied property takes is one drain on state revenue. The shortfall in revenue from the extra penny of sales tax to fund additional relief to homeowners under Act 388 is a second source of drain on the General Fund- $124 million in the current fiscal year. Together, these three state-funded sources of property tax relief are reducing revenue available for public services by about $546 million a year. Added to the two income tax changes, these tax breaks just about cover the shortfall in the current budget.

In addition to the legislative changes above, there are some problems with the revenue system that slow the growth of revenue so that it cannot keep pace with growth of population and inflation. Growth of sales tax revenue lags behind growth of personal income, in part because South Carolina has failed to follow the lead of other states in responding to the change in how households spend their money. In 1970, 45% of consumer spending was for tangible goods, which is the base of our sales tax. Today that share has fallen to 30%.

The average state taxes 57 kinds of services; South Carolina taxes only 36. The sales tax base needs to be updated to reflect the change in how we spend our money, as the Tax Realignment Commission has recommended.

We also need to address updating our excise taxes and revenue losses from such tax breaks as the sales tax cap on cars, boats, motorcycles and airplanes.

The income tax also has some structural problems. Only about 40% of South Carolinians pay any income tax. Some of us are too poor to pay income tax, but some are too old. South Carolina has the most senior-citizen-friendly income tax in the nation, according to a Georgia State study a few years ago. A family of two adults over age 65 that can take advantage of pension provisions, Social Security and the age-related deduction could have an income of more than $60,000 a year before having to pay any income tax. There are also some 53 credits available to reduce one’s income tax liability.

Unlike spending, tax breaks never come up for a scheduled annual review. They just continue from year to year, eroding the revenue base that needs to be shored up in order to continue to fund essential public services. The covenant that South Carolinians have with each other includes not only the services that we wish to ensure for all citizens but also the commitment to pay for them. Our legislators need to look closely every year at tax provisions that may have made sense 10 or 20 years ago but are never subject to review and reconsideration.

This document prepared in collaboration with Dr. Holley Ulbrich, Senior Scholar, Strom Thurmond Institute; Alumni Distinguished Professor Emerita of Economics, Clemson University

Save the date!

For more information, click here.

For more information, click here.

Seniors, Social Security and scare tactics

By Sheila Jackson, Greer SC

SC Alliance for Retired Americans

There is an attempt to frighten us all into accepting political prevarications. It goes like this: Don’t pay any attention to what we are trying to do to Social Security because its not going to be there when you young people retire anyway. We’re trying to save it. We’ll privatize it and the wonderful, infallible free market system of the purely motivated moguls of Wall Street will take good care of you. As opposed to the wasteful inefficient federal government which never does anything right.

Medicare is poorly administered and is therefore too expensive. We’ll get rid of it and give you vouchers to buy insurance on the open market. And for-profit insurance companies will gladly insure you at a reasonable, never increasing premium rate regardless of your health.

I have received my Social Security check on the third Wednesday of every month for the past 10 years. It has never failed to be there. Medicare has never failed to pay what it has promised to pay. Both administered by the federal government.

There are politicians who are funded and controlled by people who profit from the continuing redistribution of wealth from the shrinking middle class to the top 1% — who already control over a quarter of the nation’s wealth. These politicians oppose allowing the top tax rate to return to 39% even though it would hurt no one and preclude raiding the self-funding Social Security trust fund. They prefer instead to yell panic, accuse seniors of being greedy and to do all that they can to destroy something that has worked so phenomenally well to produce a healthy middle class.

Alliance for Retired Americans sends joint letter to President urging him to protect Social Security

President Barack Obama

The White House

Washington, DC 20500

Dear Mr. President:

We write you as the national officers and the presidents of the state chapters of the Alliance for Retired Americans, a national organization of four million members dedicated to securing a better quality of life for all Americans in retirement. We believe that you have the opportunity to renew the nation’s commitment to the Social Security program during the State of the Union Address next week.

Mr. President, Social Security, which just celebrated its 75th anniversary in 2010, is the nation’s premier social insurance program. It has provided economic security for millions of Americans of all ages across the last 75 years. From the nation’s youngest, who have lost a parent, to the oldest, who live in retirement, Social Security has been a constant, positive force in our nation’s life. Now, Social Security benefits go to nearly one in four American households.

Without the guaranteed benefits of the program, nearly half of older and disabled Americans would live in poverty. No other program, funded entirely by worker and employer contributions and without government funds, has had such a long lasting positive impact on American life. We are concerned, Mr. President, that many in Washington will try to take advantage of the nation’s current debt situation and cause permanent damage to the Social Security program.

As the Co-Chairs of the Commission on Fiscal Responsibility and Reform recently pointed out, the Social Security program has not contributed at all to the nation’s debt. While we disagree with many of the Co-Chairs’ Social Security recommendations, such as raising the retirement age and cutting benefits for current and future retirees, the fact remains that the current debt situation should not be a political cover for attacking the Social Security program. We strongly urge you to resist such efforts.

We urge you to speak forcefully in favor of a strengthened Social Security program. We recognize that long term efforts will be necessary to keep the program financially sound as well as being able to provide benefits that are adequate to maintain a dignified quality of life. However, the debate over the current debt situation is not the forum for debating the future of Social Security. We applaud your leadership on vital issues such as health care reform which has benefited our members. We believe you are now in a position to demonstrate that same leadership on behalf of the Social Security program.

Sincerely,

Barbara J. Easterling, President

Ruben Burks, Secretary-Treasurer

Edward F. Coyle, Executive Director

Douglas Hart, President

Arizona Alliance for Retired Americans

Nan Brasmer, President

California Alliance for Retired Americans

Vivian Stovall, President

Colorado Alliance for Retired Americans

Cal Bunnell, President

Connecticut Alliance for Retired Americans

Tony Fransetta, President

Florida Alliance for Retired Americans

Kenny Bradford, President

Georgia Alliance for Retired Americans

Al Hamai, President

Hawaii Alliance for Retired Americans

Barbara Franklin, President

Illinois Alliance for Retired Americans

Elmer Blankenship, President

Indiana Alliance for Retired Americans

Don Rowen, President

Iowa Alliance for Retired Americans

Mike Vivirito, President

Maryland/DC Alliance for Retired Americans

Dan Mikel, President

Minnesota Alliance for Retired Americans

David R. Meinell, President

Missouri Alliance for Retired Americans

Mike Owens, President

Missouri Alliance for Ret Americans Ed Fund

Bob Biel, President

Nebraska Alliance for Retired Americans

Scott Watts, President

Nevada Alliance for Retired Americans

Charlie Balban, President

New Hampshire Alliance for Retired Americans

Barbara Pardo, President

New Mexico Alliance for Retired Americans

Jim Wood, President

New York Alliance for Retired Americans

John Newman, President

North Carolina Alliance for Retired Americans

Dave Friesner, President

Ohio Alliance for Retired Americans

Jerry Morris, President

Oregon Alliance for Retired Americans

Jean Friday, President

Pennsylvania Alliance for Retired Americans

John Pernorio, President

Rhode Island Alliance for Retired Americans

Julie Harbin, President

South Carolina Alliance for Retired Americans

Shane Fox, President

Texas Alliance for Retired Americans

John Bloch, President

Vermont Alliance for Retired Americans

Mike Warren, President

Washington Alliance for Retired Americans

Sterling Ball, President

West Virginia Alliance for Retired Americans

Leon Burzynski, President

Wisconsin Alliance for Retired Americans