Tag Archives: SC Progressive Network

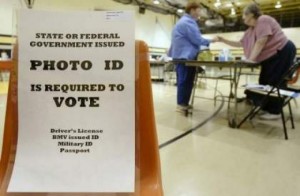

In light of new numbers, critics hammer SC voter ID law

Town halls expand Network’s voter ID campaign

The SC Progressive Network is holding a series of community forums titled “Voter ID and the new Jim Crow.” Network Director Brett Bursey will moderate. Each event will include a Q&A session and instructions for activists to work the issue in their community.

The forums will address the moving target of DOJ pre-clearance, and where we should put our efforts to try and stop it. The meeting will recognize photo ID as a symptom of larger problems, and will focus discussion on sharpening a strategy to address The Big Picture.

The Network is planning a statewide summit on Oct. 29 in Columbia to sharpen our focus and efforts. Details and agenda to be posted as they become available.

Call 803-808-3384 or email network@scpronet.com for details or to schedule a meeting in your area.

• • •

Sept. 12, Florence: 7pm at Poyner Auditorium, 319 South Dargan St.

Sept. 15, Beaufort: 6:30pm at Golden Corral, 122 Robert Smalls Pkwy. or Hwy. 170. Come early if you want to have dinner.

Sept. 20, Charleston: 7pm at ILA Hall, 1142 Morrison Dr.

Sept. 22, Greenville: 7pm at Furman University, Younts Conference Center.

Feds find SC’s photo ID law inadequate

As state works to satisfy DOJ’s questions, SC Progressive Network will continue to educate and mobilize SC voters

By Becci Robbins

SC Progressive Network Communication Director

The US Dept. of Justice denied approval of South Carolina’s new voter ID law on Aug. 29, giving the state another 60 days to make its case. As required by the Civil Rights Act, DOJ has been reviewing the law to ensure that it does not abridge the rights of minority voters.

In its ruling, DOJ asked the state eight questions about procedures on obtaining photo voter registration cards, funding for voter education and poll worker training, and the process for casting provisional ballots when a voter has no photo ID.

The SC Progressive Network filed voter affidavits and comments with DOJ, highlighting the burdens posed on rural, poor and minority voters, and the likelihood of the law’s unequal enforcement.

DOJ raised many of the concerns the Network has about how the state will work around the burden posed by voters needing a birth certificate to get the required DMV ID card. The final version of the bill included a provision that a registered voter could obtain a photo voter registration card – pending funding – that would serve as acceptable ID without mandating a birth certificate. One camera for each county office has been funded for this purpose. The cards will be made in Columbia and mailed to voters.

In an Aug. 25 submission to DOJ, the state filed draft procedures for issuing photo voter registration cards. The plan entails issuing paper voter registration cards that a voter cannot vote with unless they have the DMV photo ID. If they don’t have the required photo ID, they must go to their county voter registration office and trade in their paper registration card for a “temporary voter registration card with a photo” that is good for 30 days. Permanent photo voter registration cards with photos will be printed by the state election office and mailed to voters.

Not only is the process burdensome to voters and election workers, it is inadequately funded. In June, $1.4 million was appropriated to cover everything from buying the cameras to mailing notices to the estimated 200,000 registered SC voters with no photo ID, to educating the public and poll workers on the new law.

As confusion and costs over the ID law mount, we should remember that no one has ever been caught impersonating another voter at the polls in SC, the sort of fraud this law was designed to prevent. Rather than protecting the sanctity of the vote, as proponents claim, the new requirement does nothing but make it harder to vote in South Carolina. For some voters, the burden will be too high.

While the state digs itself deeper into a hole of its own making, the Progressive Network will continue to educate voters and expand an organized coalition of citizens to fight this and other laws compromising voting rights in South Carolina.

Now’s your chance to weigh in with US Justice Dept. on SC’s new voter photo ID law

If you, or someone you know has a hard time getting a state issued photo ID, download a Dept. of Justice Comment Form. Fill it out online and print it out (this form can not be saved and must be printed). Sign it and follow the mailing instructions at the end of the form.

Anyone can comment directly to the Department of Justice through email to: vot1973c@usdoj.gov. Put in subject line: “2011-2495: Comment”. Or comments can be mailed to:

Chief, Voting Section, Civil Rights Division

Room 7254 – NWB, Department of Justice

950 Pennsylvania Ave., N.W., Washington, DC 20530

(Include the submission # 2011-2495 at the top of your letter.)

Or fax comments to the Dept. of Justice at 202-616-9514 with the same heading.

Got questions? Call the SC Progressive Network at 803-808-3384.

Latest news from Network’s photo ID campaign

On July 8, the SC Progressive Network held a second press conference on the photo ID law to clear up misconceptions repeated by the governor and lawmakers, and to invite the public to submit comments to the US Dept. of Justice, which is reviewing the new law to consider whether it abridges the minority vote.

See more photos from the media event here.

Below is a sample of the media coverage the press conference generated.

Group seeks those impacted by new SC voter ID law

JIM DAVENPORT, Associated Press

July 8, 2011

South Carolina voting rights advocates said Friday they are looking for voters who might not be able to have their votes counted next year under one of the nation’s toughest voter identification laws. The South Carolina Progressive Network is trying to identify some of the nearly 180,000 people who are now registered to vote but who lack the state- or federal-issued photographic identification called for under the new law. Those people would be able to cast provisional ballots, but would have to show the required identification within three days to have their votes counted. Read more:

Critics challenge ‘Voter ID’ plan

By GINA SMITH

The State

When Delores Freelon was born in 1952, her mother could not decide on a name for her. So the space on the birth certificate for a first name was left blank. In the decades since, the incomplete birth certificate did not prevent Freelon from getting her driver’s license and voter registration card in the various states she has lived, including Texas and Louisiana.

But a measure — already passed by the General Assembly and signed by Gov. Nikki Haley — will create new hurdles for Freelon and others to vote. Read more:

Group aims to block voter ID law

Opponents push for rejection by U.S. Justice Dept.

BY YVONNE WENGER

The Post and Courier

COLUMBIA — The S.C. Progressive Network issued a warning Friday to the nearly 25,000 registered voters in the tri-county area without a state-issued photo ID: You could run into trouble the next time you go to the polls. The advocacy organization is urging the U.S. Department of Justice to reject a new South Carolina law that will require all voters to carry a picture ID to cast a ballot in future elections. The state’s Republican leadership pushed for the new law, citing a need to guard against voter fraud even though there has been no substantive proof of widespread voter fraud for years in the state. Read more:

Progressives Push to Stop Implementation of Voter ID Law

BY COREY HUTCHINS

Free Times

Five TV cameras, two reporters from The State, one from The Associated Press, a reporter from the Charleston Post & Courier and another from the South Carolina Radio Network, among others, swarmed around a podium in the lobby of the State House July 8, as South Carolina Progressive Network director Brett Bursey warned voters here that they might have trouble casting a ballot under a new state law. It comes during a time of a national pushback against such regulations.

New photo ID law makes it harder to vote in South Carolina than anywhere in the country

By Becci Robbins

SC Progressive Network

You could forgive voters for being confused about South Carolina’s photo ID law. Debate on the bill went on so long their eyes glazed over years ago. It’s hard to be as charitable to Gov. Nikki Haley, who twists the truth every time she defends the law she helped push through.

The governor argues that if we need a photo ID to buy Sudafed or to board a plane, we should need one to vote. Sounds reasonable, but neither pharmacies nor airlines require a state-specific ID, as this law does. And to get a SC photo ID you need to produce a birth certificate. For some people, that’s a problem.

Finally, we are number one! Sadly, it’s in voter suppression.

These documents aren’t enough for Delores Freelon to vote.

The National Conference of State Legislatures has identified seven states as having the most restrictive photo ID requirements for voting: Georgia, Kansas, Texas, Indiana, Wisconsin, Tennessee and South Carolina. All require voters to show a photo ID, but states vary in what kind and how hard it is to get.

- In Georgia, if voters are already registered, they automatically get a new photo ID voter registration card.

- In Kansas, voters can use a driver’s license from out of state, any accredited college ID, or government-issued public assistance cards. Voters over 65 may show expired ID.

- In Texas, you can get ID to vote with your concealed weapons permit, your boating license, insurance policy or beautician’s license. Or you can vote a provisional ballot if you will incur fees in order to vote. Voters over 70 are exempt.

- In Indiana, those without a photo ID get their provisional vote counted by claiming the fees to get the required documents were a burden.

- In Wisconsin, voters can use any state driver’s license, Social Security card or student ID.

- In Tennessee, a driver’s license from any state allows you to vote.

- In South Carolina, voters must produce a birth certificate to get the state-issued photo ID required to vote. No exceptions. (If you vote a provisional ballot, that won’t count unless you present your state-issued photo ID within three days.)

Numbers are hard to project, but it is clear that some of the nearly 200,000 registered South Carolina voters who don’t have their papers in order will not be able to vote in the next election.

Even though there are no cases of the kind of fraud this law is purported to prevent, our cash-strapped state will spend at least the $700,000 supporters say it will cost to implement. Opponents say it will cost two to three times that much to educate poll workers and the public about the new law. The governor has said you can’t put a price on the sanctity of the vote.

She should tell that to Delores Freelon, a Columbia resident and registered voter who won’t be able to vote in the next election because she has a Louisiana driver’s license and can’t get her birth certificate from California in time. What about the sanctity of her vote? What about Ms. Kennedy in Sumter, whose birth certificate lists her first name as Baby Girl, meaning she’ll have to go to court to get her papers straight in order to get a photo ID? Or Larrie Butler, who was born at home in Calhoun County in 1926 and is being told he needs records from an elementary school that no longer exists in order to establish a birth certificate?

Stories like these are coming in from around the state. The SC Progressive Network, which for 15 years has been advocating for voting rights, is fielding calls from people with questions about the new law or having problems meeting the ID requirements.

The lucky ones will still get to vote, but only after jumping through hoops and paying fees at various state agencies. Some will have to amend their birth certificates by going to court, at considerable cost. People without a car, a computer or short on money are simply out of luck. The disenfranchised will be primarily seniors and the poor. Many of them will be people of color who have voted all their lives.

The Network is working to educate the public about the new law.

The Network is working to educate the public about the new law.

This quiet whittling away of the vote is no accident. It is, in fact, the point. It’s the pattern being repeated in GOP-controlled legislatures across the country.

In South Carolina, we have a brief chance to challenge this law. Because of our state’s history of disenfranchising people of color, ours is one of seven states that must get pre-clearance from the US Dept. of Justice (DOJ) before new voting laws can go into effect. Once the state attorney general files the case, DOJ has up to 60 days to consider whether the law suppresses the minority vote.

The SC Progressive Network is gathering statements to forward to DOJ documenting voters’ experiences. We need volunteers around the state to help find citizens who will have a hard time meeting the new voting requirements. If you want to help, call the Network at 803-808-3384 or see scpronet.com for details.

See video clips of Delores Freelon and Larrie Butler telling their stories.

As Senate takes up budget, town hall panel to debate role of special-interest tax breaks

Is South Carolina broke? That’s what the governor and a majority of the state legislature are saying. What if the state isn’t broke, but is leaving billions in revenue out of the budget because of special-interest tax breaks?

That’s the question to be debated at a town hall meeting April 27, 7pm, at the SC State Museum, 301 Gervais St. in Columbia. The forum is free and open to the public.

With the Senate set to begin debate on the budget April 26, it’s important that the public have a say in our funding priorities. The town hall was organized because the Senate is not allowing any opportunity for public comment during its deliberations.

The town hall will debate the argument that the state is broke, and will provide striking details about the $4 billion left out of the budget through special tax breaks.

Dr. Holley Ulbrich, Professor Emerita of Economics at Clemson University, will present the case that there is sufficient revenue to fund a moral budget that reflects our values as a society. “By any measure, our state and local tax system has failed to reflect our shared values of justice, of freedom, of compassion, and of opportunity,” Ulbrich said. “Instead, we have focused on tax cuts and failed to update our antiquated revenue system, standing idly by while our tax base continues to erode.”

Dr. Mike Fanning, who has been working with Chambers of Commerce across the state to promote comprehensive tax reform, will lay out the case to lower taxes and balance the budget. “How can a state claim to be broke?” Fanning asked. “Our legislators choose to collect taxes at twice the rate needed to run government while giving away billions in special interest exemptions.”

Network Director Brett Bursey said, “The Chambers of Commerce and the Progressive Network agree that tax breaks are leaving too much money on the table and that our political leadership refuses to acknowledge that the money exists. When the public understands we’re not broke and forces the politicians to reform the tax code, then we can have a productive fight over how to spend the money.”

The Chambers would use the revenue to reduce state taxes and balance the budget. The Network wants the money to enhance the budget and fund crumbling public services. The legislature and the governor are opposed to raising revenue, and see no alternative to cutting government programs.

After a panel discussion, the public will be invited to ask questions and make comments. This is a 90-minute opportunity for the public to understand that South Carolina is not broke, and that the real debate should be over what to do with the additional revenue.

A 2011 study by the Tax Foundation found that South Carolinians have the lowest state income tax burden in the nation and rank 43rd in combined state and local taxes.

The Organization of Economic Cooperation and Development, with 34 “first world” member nations, ranks the United States 33rd in collection of taxes, compared to the country’s wealth. Only Mexico ranked lower.

SC groups join forces to rally for a moral budget

By Becci Robbins

SC Progressive Network

A growing number of churches, educators, health care providers, grassroots groups and professional organizations will rally in Columbia on Saturday, March 12, at 1pm at the State House to demand that lawmakers “Stop the cuts! Fund a moral budget.” The House begins debate on the budget March 15.

“Budgets are moral documents” said Rev. Brenda Kneece, Executive Minister of the SC Christian Action Council. “A civilized society chooses to do together what individuals or organizations cannot do alone: protect all and provide for the vulnerable.”

According to the recent report by the Tax Realignment Commission (TRAC), created by the legislature to reform SC tax codes — a report that was quickly shelved — South Carolina imposes one of the country’s lowest individual income tax burdens. An estimated $3.7 billion was left out of the current budget due to sales and service tax exemptions alone.

“The problem isn’t money,” said Brett Bursey, Director of the SC Progressive Network. “The problem is a political ideology that’s both anti-government and anti-taxes. Exemptions, deductions and tax credits leave enough money out of the state budget to meet our needs, with some left over for improvements. We have to send a clear message to the legislature that the race to the bottom must end, and revenue must be raised to fund critical services.

“The money is there,” Bursey said. “The political will is not.”

“We are 1,000 percent behind this rally and are urging all state employees to be there,” said SC State Employee’s Association Interim Director Joe Benton. “Further budget cuts will result in more layoffs and furloughs that hurt not only state employees and their families, but the citizens they serve.”

Jackie Hicks, President of the South Carolina Education Association, South Carolina’s oldest and largest professional association of educators, is encouraging her members to rally to protect and defend public education. “For too long, we’ve allowed legislators to shirk their duty to provide adequate, equitable and stable funding for South Carolina’s public schools and the students they serve. Our current funding is totally inadequate for the educational services our students need.”

Rev. Kneece said, “As faithful citizens we are called to come together through budgets and the taxes that fund them to “Speak up for those who cannot speak for themselves, for the rights of all who are destitute. Speak up and judge fairly; defend the rights of the poor and needy (Proverbs 31:8-9, New International Version).”

Over the past two years, the state budget has been cut from $7.9 to $5 billion, making severe cuts to state services. Further cuts, being debated in the legislature, propose more reductions in health care services to nearly 900,000 Medicaid recipients, ending preventative care, AIDs drug programs, aid for needy children; more teacher’s jobs lost, larger classes, higher tuition; the end of SCETV and the Arts Commission – just to name a few of the casualties.

Life will be harder, with fewer opportunities, especially for the 25 percent of our children living in poverty.

Initial Sponsors: SC AFL-CIO • SC Christian Action Council • SC Education Association • S.C. HIV/AIDS Care Crisis Task Force • SC NAACP • SC Progressive Network • SC State Employees Association • Ties That Bind

For more information, see scpronet.com, email network@scpronet.com or call 803-808-3384.

The budget is a moral document

Dr. Holley Ulbrich

Senior Scholar, Strom Thurmond Institute

A budget is a moral document. It expresses our values and our priorities as South Carolinians. It reminds us that each of us, four million plus South Carolinians, has needs to be met and gifts to offer the world.

One of our most deeply held American values is justice. We try to do that work of justice and compassion as individuals and through congregations and other private organizations. But the task is enormous. These scattered and individual efforts are not enough. Fifteen percent of South Carolinians lives in poverty—the 9th highest rate in the country.

Our underfunded schools are failing to develop our children’s talents and prepare them to become self-supporting, contributing members of society. We are not taking on those reciprocal responsibilities to one another as fellow citizens of South Carolina. The budget is an expression of our obligations to one another, and at present our budget demonstrates a lack of commitment, a failure to pay more than lip service to our shared values.

To treat everyone justly and fairly, we need to provide them with both freedom and opportunity. Freedom is not just freedom to, it is also freedom from. The four freedoms—freedom of speech and religion, freedom from want and fear—are all essential to human flourishing. Our children will not have that freedom and opportunity without providing them an adequate education for a demanding 21st century economy.

Those who cannot earn enough on their own—the disabled, the sick, the elderly, the children in single-parent homes where working mothers can’t earn enough to meet their needs—do not have freedom from want and fear, or opportunity to escape from poverty. Prisoners who are overcrowded and lack access to exercise and education have little or no opportunity to re-enter society as productive human beings leading meaningful lives.

The failure to maintain the state’s infrastructure, especially transportation infrastructure, will make it increasingly difficult to attract and retain business firms to provide employment opportunities for our workers, who still suffer from one of the highest unemployment rates in the nation.

Yet our state General Fund spending per person, adjusted for inflation, is lower than it was 10 years ago-$1,156,compared to $1,229 in the 1999-2000 budget. The 2010 budget per person was at the 1984 level in constant dollars. We are asking our teachers, our prisons, our colleges and universities, our health services and public safety officers to do more with less, and do it with 21st century technology.

Is there another way? Yes.

The budget is a moral document not only on the spending side, which displays our priorities for all to see, but also on the revenue side. How much are we able and willing to contribute to meeting the needs of our fellow citizens? By any measure, our state and local tax system has failed to reflect our shared values of justice, of freedom, of compassion, and of opportunity. Instead, we have focused on tax cuts and failed to update our antiquated revenue system, standing idly by while our tax base continues to erode.

Taxes are low in South Carolina, and getting lower. South Carolina ranks 47th out of 51 states (including the District of Columbia) in taxes as a percent of income and 51st in taxes per capita. Yet low taxes have not succeeded in the supposed goal of attracting and retaining industry, because business firms care about more than taxes. Business location studies show that firms care about an educated work force, an adequate transportation system, a consumer market that can afford to buy their products and services, and quality of life for the firm’s employees.

South Carolina’s sales tax system is eroding rapidly. One factor in that erosion is tax cuts over the last 10 years. Changes in the income tax that allow unincorporated business to file at the same 5% rate as corporations and eliminate the bottom bracket (which affects all taxpayers) on the individual income tax have cost the state more than $200 million a year. State-funded property tax relief has been a major drain on the state’s revenue.

The homestead exemption for the elderly and the original relief on the first $100,000 of owner-occupied property takes is one drain on state revenue. The shortfall in revenue from the extra penny of sales tax to fund additional relief to homeowners under Act 388 is a second source of drain on the General Fund- $124 million in the current fiscal year. Together, these three state-funded sources of property tax relief are reducing revenue available for public services by about $546 million a year. Added to the two income tax changes, these tax breaks just about cover the shortfall in the current budget.

In addition to the legislative changes above, there are some problems with the revenue system that slow the growth of revenue so that it cannot keep pace with growth of population and inflation. Growth of sales tax revenue lags behind growth of personal income, in part because South Carolina has failed to follow the lead of other states in responding to the change in how households spend their money. In 1970, 45% of consumer spending was for tangible goods, which is the base of our sales tax. Today that share has fallen to 30%.

The average state taxes 57 kinds of services; South Carolina taxes only 36. The sales tax base needs to be updated to reflect the change in how we spend our money, as the Tax Realignment Commission has recommended.

We also need to address updating our excise taxes and revenue losses from such tax breaks as the sales tax cap on cars, boats, motorcycles and airplanes.

The income tax also has some structural problems. Only about 40% of South Carolinians pay any income tax. Some of us are too poor to pay income tax, but some are too old. South Carolina has the most senior-citizen-friendly income tax in the nation, according to a Georgia State study a few years ago. A family of two adults over age 65 that can take advantage of pension provisions, Social Security and the age-related deduction could have an income of more than $60,000 a year before having to pay any income tax. There are also some 53 credits available to reduce one’s income tax liability.

Unlike spending, tax breaks never come up for a scheduled annual review. They just continue from year to year, eroding the revenue base that needs to be shored up in order to continue to fund essential public services. The covenant that South Carolinians have with each other includes not only the services that we wish to ensure for all citizens but also the commitment to pay for them. Our legislators need to look closely every year at tax provisions that may have made sense 10 or 20 years ago but are never subject to review and reconsideration.

This document prepared in collaboration with Dr. Holley Ulbrich, Senior Scholar, Strom Thurmond Institute; Alumni Distinguished Professor Emerita of Economics, Clemson University